Calculating interest accumulation is crucial for understanding the growth of your personal finances, whether it’s for savings accounts, loans, or investments. Understanding how interest works can help you make informed decisions about your financial future both to benefit from compounding and avoid the pitfalls.

Thankfully, spreadsheets offer a simple yet powerful tool for these calculations—no need for advanced financial software. This post will guide you through setting up a spreadsheet to track and calculate interest accumulation step-by-step, allowing you to take control of your financial planning. However, if you want an easy solution to get started straight away then you can use our cumulative interest calculator.

Understanding Interest Types

Simple vs. Compound Interest

Interest can be calculated in different ways, and it’s important to understand the differences.

Simple Interest:

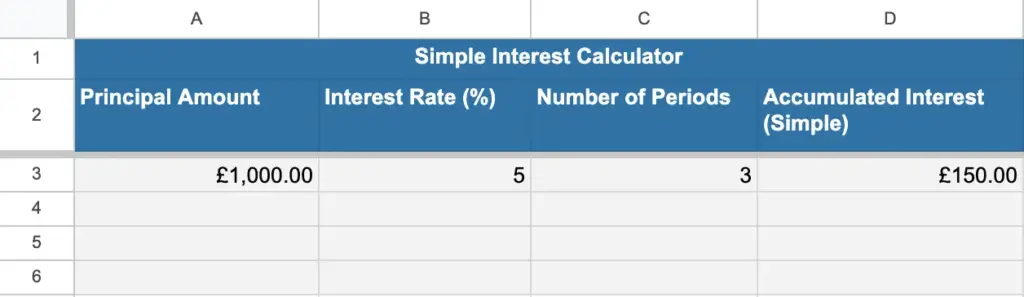

This is calculated only on the principal amount, or the initial amount of money invested or borrowed. The formula is straightforward: Interest = Principal × Rate × Time. For example, if you invest £1,000 at an interest rate of 5% annually for 3 years, the interest would be 150.

Compound Interest:

This type of interest is calculated on the principal amount as well as on the accumulated interest of previous periods. It grows much faster because you earn interest on interest. This makes compound interest a powerful tool for building wealth over time.

Setting Up the Spreadsheet

To get started, you’ll need to set up some basic columns in your spreadsheet:

- Principal Amount: The starting amount of money.

- Interest Rate: The rate at which interest will be applied (e.g., 5%).

- Number of Periods: This could be in years, months, or any other time unit depending on the type of interest calculation.

- Accumulated Interest: The total interest accumulated over time. Set up these columns side-by-side to keep the data organized. You can also add additional columns for better analysis, such as Total Value to see the overall balance including principal and interest.

Calculating Simple Interest in Spreadsheets

Formula Breakdown

To calculate simple interest, use the formula: Interest = Principal × Rate × Time.In your spreadsheet, enter the following:

- Principal Amount in cell A2 (e.g., £1,000).

- Interest Rate in cell B2 (e.g., 5%).

- Number of Periods in cell C2 (e.g., 3 years).

- In D2, enter the formula to calculate interest:

=A2 * B2 * C2. This will automatically compute the simple interest.

Practical Example

Imagine you want to see how changing the time period affects interest. Simply update the value in C2, and the interest in D2 will update automatically. This dynamic setup allows you to play with different scenarios easily.

Calculating Compound Interest in Spreadsheets

Formula Breakdown:

Compound interest uses the formula: ![]() , where:

, where:

- P is the principal amount.

- r is the annual interest rate.

- n is the number of times interest is compounded per year.

- t is the number of years.

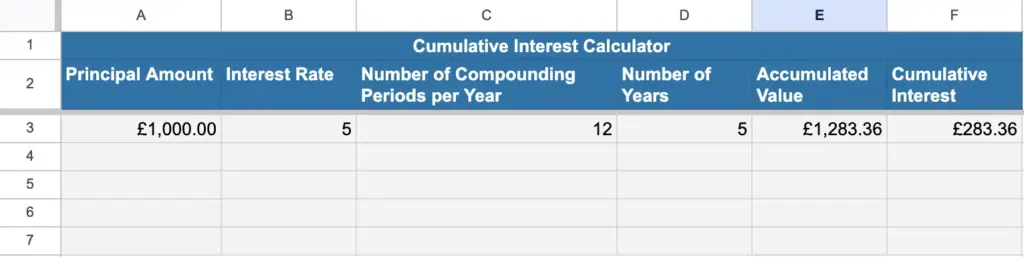

Applying the Formula in a Spreadsheet

Let’s break down how to use this formula in a spreadsheet:

- In A2, enter the Principal Amount (e.g., £1,000).

- In B2, enter the Interest Rate (e.g., 5%).

- In C2, enter the Number of Compounding Periods per Year (e.g., 12 for monthly).

- In D2, enter the Number of Years (e.g., 5).

- In E2, use the formula:

=A2 * (1 + B2 / (C2 * 100)) ^ (C2 * D2)to calculate the accumulated value.

- In F2, use the formula:

=(A2 * (1 + B2 / (C2 * 100)) ^ (C2 * D2)) - A2to calculate the cumulative interest.

This will show how your balance grows with compound interest. To compare, you could adjust C2 from monthly to yearly compounding and observe how it changes the accumulated value.

Automating Interest Calculations

Using Spreadsheet Functions

Spreadsheets offer built-in functions that make calculations even simpler. The FV (Future Value) function is a great tool to calculate compound interest without manually using the entire formula.

- Example: To calculate the future value of an investment, use

=FV(B2 / C2, C2 * D2, 0, -A2). - This formula calculates how much your investment will be worth after compounding, assuming no additional contributions.

Creating a Simple Interest Calculator Template

To make your life easier, create a simple interest calculator template:

- Set up all required cells for Principal, Rate, and Time.

- Include conditional formatting to highlight high interest gains.

- Save this as a reusable template for future calculations.

Visualising Interest Growth

Adding Graphs for Clarity

A great way to better understand interest accumulation is to visualise it. Create a line graph or bar chart to display the growth of your principal over time.

- Highlight cells that include principal and accumulated balance.

- Use the Insert Chart feature to plot your data. This visual representation can help you see how compounding really affects growth.

Practical Use Cases

Tracking Savings Goals

Use the spreadsheet to track savings goals. For example, if you want to save for a vacation, input your monthly contributions and interest rate to see how long it will take to reach your target amount.

Loan Repayment

You can also use this technique for calculating interest on loans. Input your principal (loan amount), interest rate, and loan term to see how much interest you will pay over time. This helps with better planning for repayment.

Spreadsheets offer a powerful, flexible way to manage and understand interest accumulation. By setting up your own calculations, you gain insights into how your money grows and how different interest rates or compounding frequencies affect your finances. Don’t hesitate to experiment with your own data, and over time, you’ll become more comfortable analysing more complex scenarios.

Feel free to make a copy of our sample cumulative interest spreadsheet template to get started.